Tips for obtaining a home loan – Dreaming of having your very own home? Safeguarding a home loan can appear complicated, however with the best method and a little preparation, it’s most definitely attainable. This overview uses some sensible suggestions to browse the home loan procedure and boost your possibilities of obtaining accepted.

Understanding Your Financial Situation is vital. Prior to you also begin considering residences, take a difficult take a look at your existing economic health and wellness. This consists of:

- Your Income: Lenders wish to see constant earnings. The even more steady your earnings, the far better your possibilities of authorization.

- Your Expenses: Track your regular monthly expenditures meticulously. Lenders examine your debt-to-income proportion to establish just how much you can pleasantly manage.

- Your Credit Score: An excellent credit history is important. If required, job on enhancing it. Think about a credit rating record evaluation to identify any type of locations for enhancement.

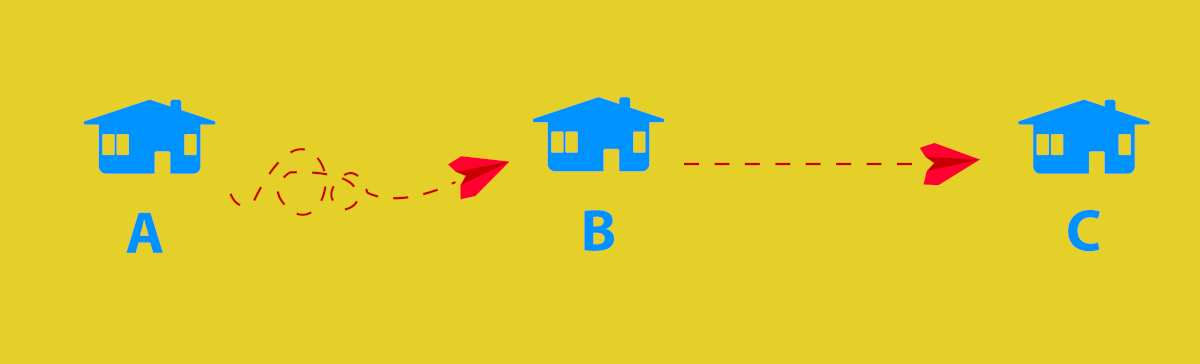

Shopping Around for the very best Mortgage Rates is vital. Do not choose the very first lending institution you talk with. Contrast rate of interest, charges, and terms from various loan providers. Search for trustworthy loan providers with a solid performance history. Think about it like buying the most effective offer on a cars and truck – you wish to obtain the most effective feasible rate.

Preparing Your Documentation will certainly conserve you a great deal of migraines later on. Collect all the required files and info well ahead of time. This consists of:

- Proof of Income: Pay stubs, income tax return, and W-2 types.

- Proof of Assets: Bank declarations and financial investment documents.

- Credit Report: A duplicate of your credit score record can assist you determine any type of mistakes.

- Other Important Documents: Depending on your situations, you may require extra files like pay stubs, rental arrangements, or income tax return.

Consider Pre-Approval When you’re all set to acquire a home, obtaining pre-approved for a home loan can provide you a substantial benefit. It allows you recognize just how much you can manage and enables you to with confidence make deals on buildings that fit your spending plan. When discussing with vendors, this will certainly additionally provide you a solid placement.

Don’t Be Afraid to Ask Questions Do not think twice to ask your lending institution or a monetary consultant for information if you’re unclear concerning any type of facet of the home loan procedure. Understanding the problems and terms is vital for making educated choices. A clear understanding of the home loan contract will certainly make the entire procedure much less difficult.

Seek Professional Advice Think about seeking advice from an actual estate representative or a monetary consultant that specializes in home mortgages if you’re really feeling bewildered. They can lead you with the procedure and assist you make the most effective choices for your circumstance. Do not hesitate to utilize professional understanding!

Remember, purchasing a home is a substantial economic choice. Putting in the time to comprehend the procedure and prepare completely will establish you up for success. All the best!